What's HDB Mortgage Interest?

The Housing & Enhancement Board (HDB) in Singapore supplies housing loans that can help Singaporean citizens and long lasting people finance the purchase of community housing.

1 significant aspect of these loans is the curiosity that borrowers are needed to spend to the loan volume borrowed.

Forms of HDB Personal loan Interest Premiums

Preset Curiosity Fee:

Features stability since the desire rate remains consistent all over a specific time period, normally for the main few years.

Floating / Variable Interest Charge:

Can fluctuate along with current market desire fees, leading to adjustments in regular monthly repayments.

Board Amount:

Based on HDB's board and might be revised periodically dependant on various elements like economic circumstances.

Aspects Affecting HDB Mortgage Interest Rates

Market Circumstances: Financial traits, inflation premiums, and Primary lending costs can effect curiosity prices offered by economical establishments which include HDB.

Pitfalls Concerned: Borrowers' credit history, present debts, and repayment capability influence the sort of fascination charge they qualify for.

Promotions: Periodically, HDB may give Exclusive promotions or discount rates on their personal loan deals which may more info affect the general curiosity level.

Controlling HDB Mortgage Desire

Engage with economical advisors or home finance loan professionals to understand implications of differing types of interests ahead of choosing one which suits your fiscal scenario.

On a regular basis assessment and negotiate with HDB about refinancing alternatives if there are far more favorable desire prices readily available in the market for the duration of your loan tenure.

Conclusion

Comprehension how HBD personal loan interests operate is very important when obtaining community housing in Singapore. By staying aware about different types of interest charges readily available, factors influencing them, and methods for controlling them proficiently, borrowers can make informed decisions that align with their economic ambitions and abilities.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Mara Wilson Then & Now!

Mara Wilson Then & Now! Danielle Fishel Then & Now!

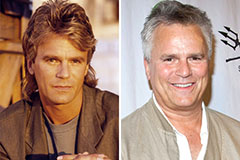

Danielle Fishel Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!